Since there is no absolute equivalence of the degree as CA in India with relevant degree in Canada, settling in Canada as a Chartered Accountant from India, though is easy, yet would face some challenges. The settlement in Canada would depend on various factors, including experience, language proficiency, province chosen to settle and more importantly networking skills.

Here are some points to consider:

Professional Qualifications and Credential Assessment:

Indian CA qualification is not directly recognized in Canada. To work as a Chartered Accountant in Canada, you will need to go through a process of credential assessment and take additional exams to meet the Canadian requirements.

You’ll need to have your educational and professional credentials assessed by the appropriate Canadian authorities. Organizations such as the Canadian Information Centre for International Credentials (CICIC) and provincial regulatory bodies can help you understand how your qualifications align with Canadian standards.

Language Proficiency:

Proficiency in English or French is crucial for success in Canada. Good communication skills are essential for job interviews, and daily life.

Networking:

Building a professional network is important for finding job opportunities and settling quickly. Joining local accounting associations, attending networking events, and using online platforms can help you connect with potential employers and other professionals in your field.

Working under a mentor can also help to settle faster in Canada. Your guide under which you are doing mentorship, if satisfied with your work, may recommend you with one of his clients or networks.

Scope of a Chartered Accountant in Canada also varies from Province to Province:

Not all provinces in Canada offer similar growth opportunities for a Chartered Accountant to settle.

Some provinces in Canada that offer great opportunities are:

Ontario:

Ontario, particularly the Greater Toronto Area (GTA), is the economic hub of Canada. It has a diverse and dynamic business landscape, offering numerous opportunities for accountants in various industries. The GTA is home to many major corporations, financial institutions, and accounting firms.

Alberta:

Alberta, specifically cities like Calgary and Edmonton, has a strong energy sector, including oil and gas, which can provide accounting professionals with opportunities in this industry. Additionally, the province has a growing technology sector and a generally lower tax environment.

British Columbia:

Cities like Vancouver and Victoria offer a mix of industries including technology, film and television production, tourism, and natural resources. The province’s diverse economy can provide accountants with a range of job prospects.

Quebec:

Montreal is a major economic center in Canada, and the province of Quebec has a unique mix of industries including aerospace, technology, and finance. Bilingualism (English and French) can be an advantage in this province.

Saskatchewan:

The province has a resource-based economy with industries like agriculture, mining, and energy. Its cost of living can be relatively lower compared to some other provinces.

Manitoba:

Winnipeg, the capital city, offers opportunities in various sectors including manufacturing, finance, and healthcare.

That said, provinces with smaller economies, fewer major industries, or less population density have fewer opportunities for Chartered Accountants, especially if they are not from Canada to have a flourishing career. Such provinces include:

Prince Edward Island:

As the smallest province by population, it offers fewer opportunities in comparison to other larger provinces in Canada.

Newfoundland and Labrador:

While the offshore oil and gas industry has been a significant sector, this province’s economy is not strong due to fluctuations in commodity prices.

New Brunswick:

This province is home to fewer large corporate headquarters and industries compared to other more populous provinces.

Settling in these provinces would mean that a Chartered Accountant would be serving smaller businesses that require accounting services and often offer remote work jobs.

Please note that economic conditions and opportunities in any province can change over time, so it’s a good idea to research the job market for opportunities available to you before making a decision.

Experience:

Your work experience as a Chartered Accountant in India could be valuable in Canada, but it might not be directly equivalent. You may need to gain some Canadian work experience to enhance your profile and demonstrate your skills in a local context. A Chartered Accountant from India or from any other country would need to familiarize himself with Canadian tax laws, financial regulations as they may differ from those in Parent Country.

What improvement in education or other studies that a Chartered Accountant from India would need to do in Canada:

Additional Courses:

Depending on the results of the credential assessment, you might need to take additional courses to bridge any gaps between your Indian education and Canadian requirements. These courses could cover Canadian tax laws, accounting regulations, and business practices.

Canadian Accounting Standards:

Familiarize yourself with Canadian Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), as these might differ from what you learned in India.

Taxation Laws:

Gain knowledge about Canadian tax laws, including federal and provincial tax regulations. A strong understanding of Canadian tax codes will be crucial, especially if you’re working in taxation or advisory roles.

Professional Designations:

Consider pursuing additional professional designations recognized in Canada, such as the Chartered Professional Accountant (CPA) designation. This can enhance your credibility and employability in the Canadian job market.

Soft Skills and Communication:

Improving your language skills (English or French) and enhancing your communication and presentation skills will be beneficial in effectively communicating with colleagues, clients, and stakeholders.

Adaptability and Cultural Understanding:

Learn about Canadian workplace culture, communication norms, and business etiquette. Cultural sensitivity and adaptability are important for integrating well into the Canadian work environment.

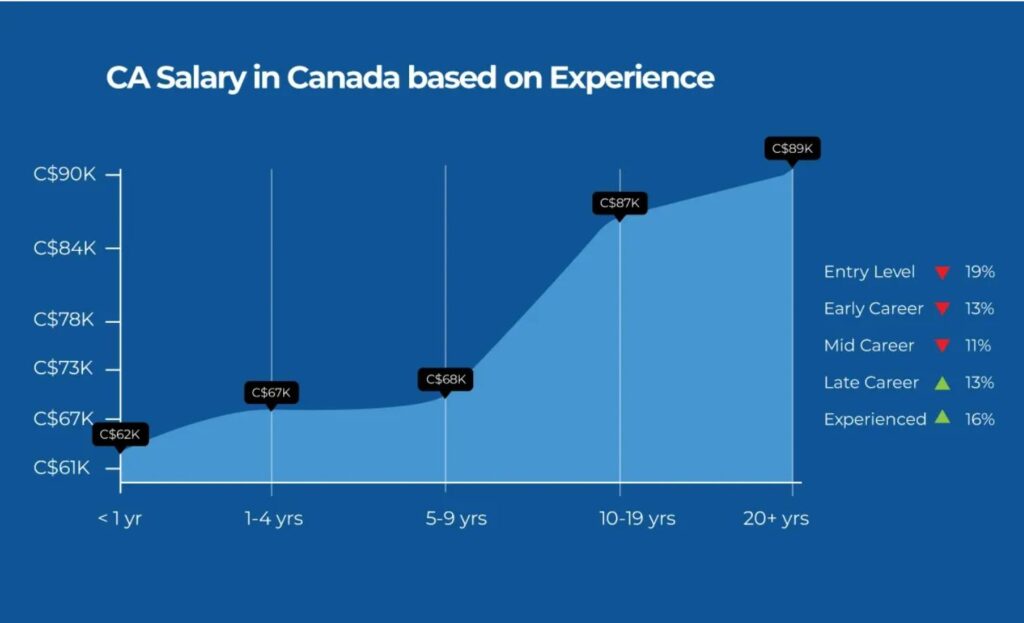

Earning Potential for Chartered Accountants in Canada:

Working as employees in industries, corporations, government agencies, or non-profit organizations can earn competitive salaries. Entry-level positions might start around CAD $50,000 to $70,000 per year, but with experience and promotions, salaries can rise significantly. Mid-level and senior-level positions can earn between CAD $80,000 to $150,000 or more per year.

Public Practice:

Chartered Accountants who work in public practice, such as in accounting firms (small, mid-sized, or large), can earn a range of incomes. Starting salaries for junior associates might be in the range of CAD $45,000 to $70,000 annually. As you progress and gain experience, you can move up the ranks and potentially become a partner in the firm, which can significantly increase your earning potential. Partner-level income can vary widely but can be well into six figures or even more.

Specializations and Certifications:

Earning potential can also be influenced by specializations and additional certifications such as CPA (Chartered Professional Accountant) designation, which replaced the CA, CMA, and CGA designations in Canada. Specializing in high-demand areas like forensic accounting, management consulting, taxation, and financial planning can lead to higher earning potential.